🚀

Introducing Molecule v313 Upgrades

Release v313 introduces some really nice upgrades to Molecule, including fully automated FTR valuation across PJM nodes, 5-minute PPA granularity, and customizable VaR calculations. In addition, we have launched enhanced visualizations and tools for analyzing market data, which we will be rolling out over the next few weeks. But you can see a preview below!

With these enhancements, Molecule continues to lead in providing accurate data and innovative software tools for our users!

• • •

⚡ FTR/CRR FORWARD CURVES – AUTOMATED NODE-BASED VALUATION

We’ve automated forward curve valuation for FTRs in PJM* markets, removing manual workflows and enabling full mark-to-market coverage across all traded nodes. The system ingests and transforms auction results and node-level pricing data daily, using intelligent logic that supports all PJM time blocks—including on-peak weekday, on-peak weekend, and off-peak periods. Overnight valuation runs are now faster and more efficient, providing quicker risk visibility and operational benefits for your team. And, it's all powered by a resilient, fault-tolerant orchestration layer that streamlines the entire FTR workflow.

End-to-End Workflow Automation & Monitoring - A new workflow engine now drives the FTR processing pipeline, from market data ingestion to valuation, with automated error recovery, monitoring, and full traceability. It handles delayed or incomplete files seamlessly, and infrastructure upgrades enhance system stability and visibility, paving the way for future growth.

Automated Mark Generation & Valuation Logic - FTR marks are generated and valued automatically using PJM-specific rules, including precise hourly block calculations and per-MWh conversions. These improvements enhance accuracy and reduce manual effort across congestion and transmission processes.

Performance & Scalability - Valuation performance incorporates smart filtering, deduplication, and handling of large position sets, reducing system load and speeding up daily runs.

* feature to include support for California ISO and other ISOs in the near future!

• • •

☀️ POWER PURCHASE AGREEMENTS – SUB-HOURLY SUPPORT & VALUATION ENHANCEMENTS

We’ve significantly upgraded our PPA valuation capabilities to support complex long-term agreements with sub-hourly granularity and improved fee calculations. Molecule now has what we believe to be unparalleled precision and reliability, enabling deeper analysis and more sophisticated trading strategies across all sub-hourly intervals.

Sub-Hourly Granularity: At 5 or 15 min intervals [OME-120 / OME-128 / OME-170]

You asked, and we delivered. Our latest upgrade was driven by your need for greater precision in managing modern PPAs. By integrating native support for 5- and 15-minute market data, we have eliminated the limitations of hourly calculations. This means your trades are now valued with accurate position and settlement calculations are supported for all intervals, including early morning legs, ensuring precise valuation of sub-hourly trades.

Enhanced Valuation Formula [OME-101 / OME-144]

Valuation formulas now accept product, asset product, and asset name as arguments within the hourly_forecasted_average function. These can be used directly in curve builder formulas, with improved reliability and fixes for saving complex PPA configurations.

Fee Calculation Improvements [OME-50 / OME-142]

Per-unit fees are now calculated accurately based on actual generated volumes. Fees properly cascade from monthly to daily and hourly trade legs, and realized fees appear only on appropriate trade legs to prevent double accounting. As-generated support dynamically calculates fees from actual generation data.

• • •

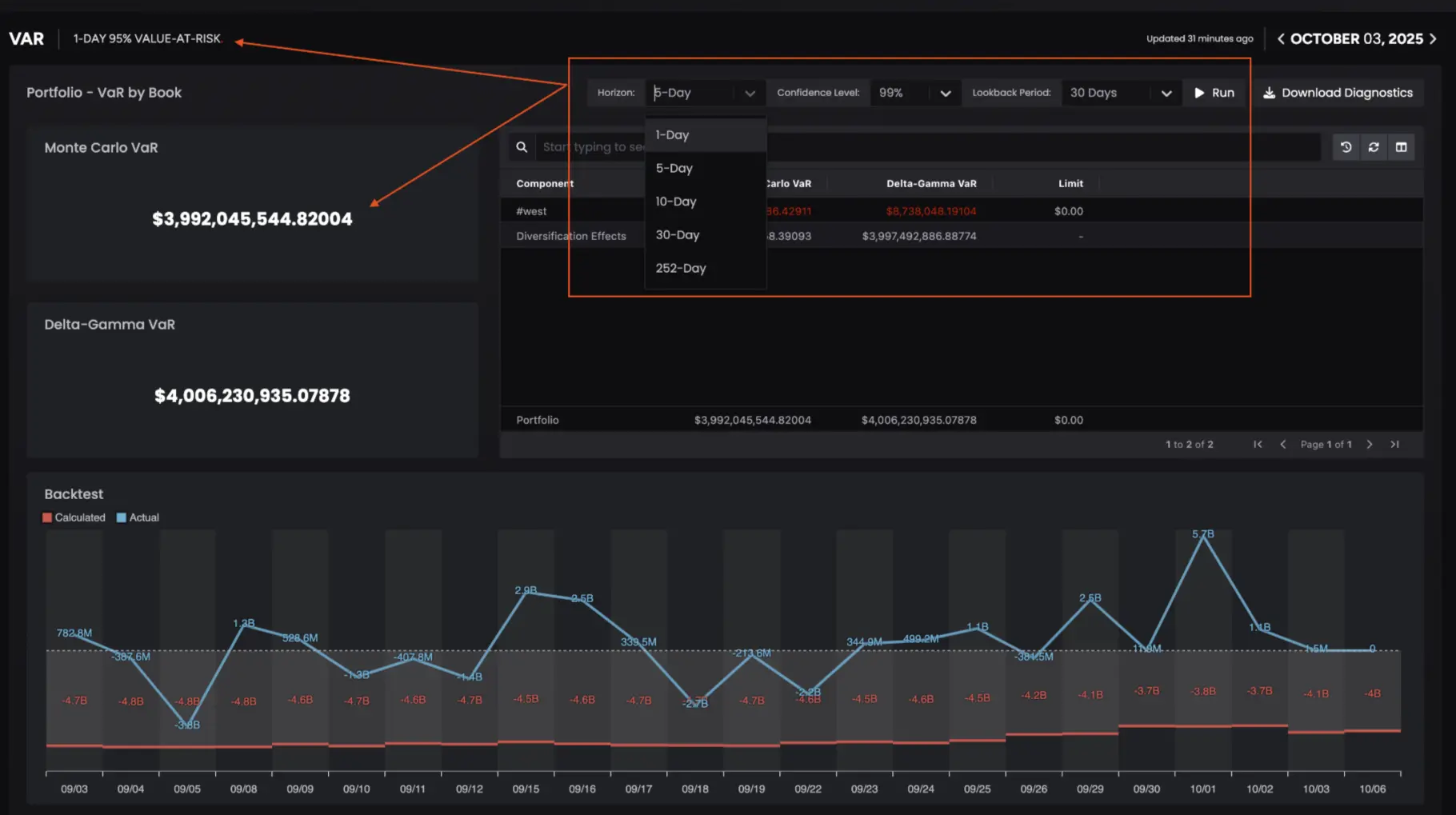

📊 VALUE AT RISK (VaR) – ENHANCED CALCULATION & CONFIGURABILITY

We’ve delivered major improvements to our VaR engine, addressing critical calculation accuracy, multi-period support, and customer configurability for regulatory and board-level reporting.

Enhanced Calculation Methodology [OME-73 / OME-145]

Implemented mean-centered covariance calculations for more accurate risk correlation and switched to log-normal returns, aligning with financial best practices. Diagnostic reporting now includes properly scaled covariance values.

Trading Day Intelligence [OME-77]

VaR now correctly excludes non-trading days (weekends and holidays) from volatility calculations. This eliminates artificial risk dampening from copied weekend prices and ensures compliance-ready metrics for executive and board reporting.

Multi-Period Horizon Support [OME-78]

Users can now calculate VaR for 1-day, 5-day, and 252-day (annual) periods, with all horizons correctly aligned to business days only.

Customer-Configurable Parameters [OME-146 / OME-167]

Key VaR parameters — horizon, lookback period, and confidence level — can now be configured directly from the interface. Users can run on-demand VaR analysis with custom parameters, receive real-time completion alerts, and test different risk scenarios while maintaining corporate defaults.

• • •

🎨 MIRAGE UI: MARKET DATA SCREEN PREVIEW

We’ve completely redesigned the Market Data screen in Mirage, adding powerful tools for managing and visualizing large data sets. Though live. you won't see them in the app quite yet, but they'll be rolling out in the coming weeks.

Here is a sneak peak at some of what's coming...

Market Data Grid & Detail Views [ALP-90 / ALP-92]

A comprehensive new grid displays curves with enhanced filtering and sorting. The detail view supports individual mark management, bulk operations for uploading/downloading/deleting marks, and visual graph integration with hover highlighting.

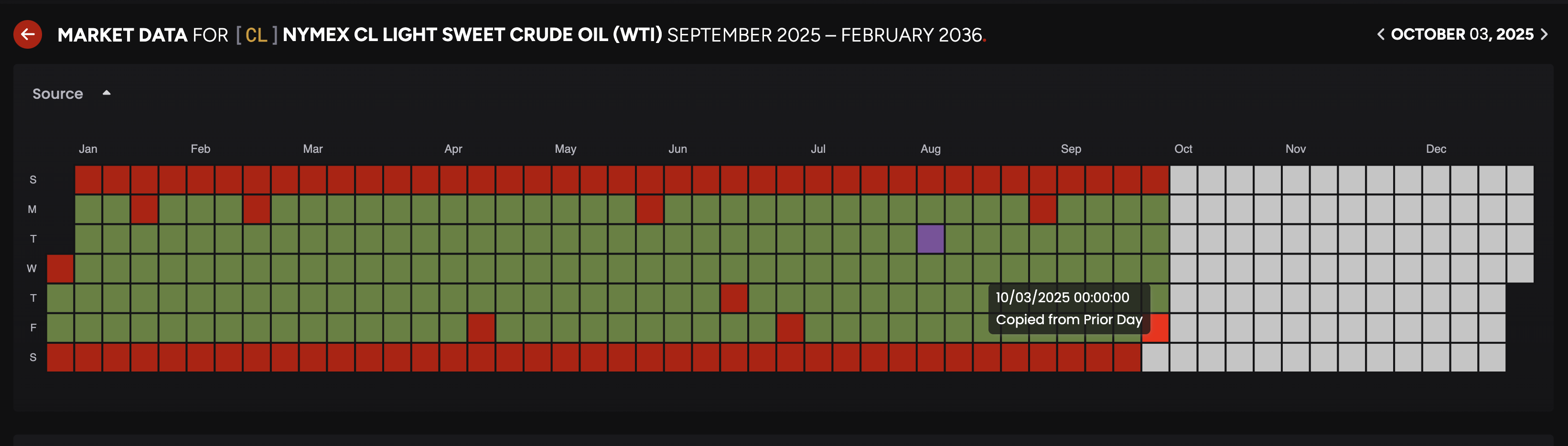

Curve Source Heatmap [ALP-60]

A new GitHub-style heatmap shows curve data availability year-to-date with color-coded indicators and hover details displaying exact timestamps of updates.

Daily Curve Tracker ALP-62

Monitor up to 10 curves with a 10-day historical view. Red and green indicators highlight missing or received data, automatically detecting curves missing today that were present yesterday.

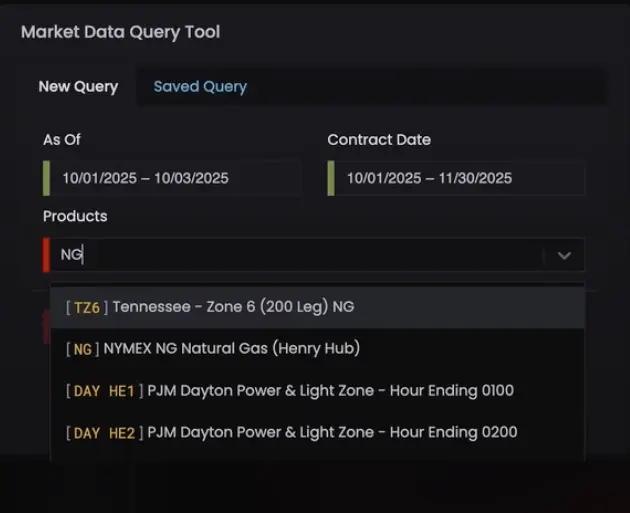

Query Tool [ALP-78]

Create and save custom queries for frequently accessed data combinations. Supports as-of date ranges, contract starts, and up to 50 products, with results downloadable as formatted Excel workbooks.

🎨 MIRAGE UI: ADDITIONAL UPDATES

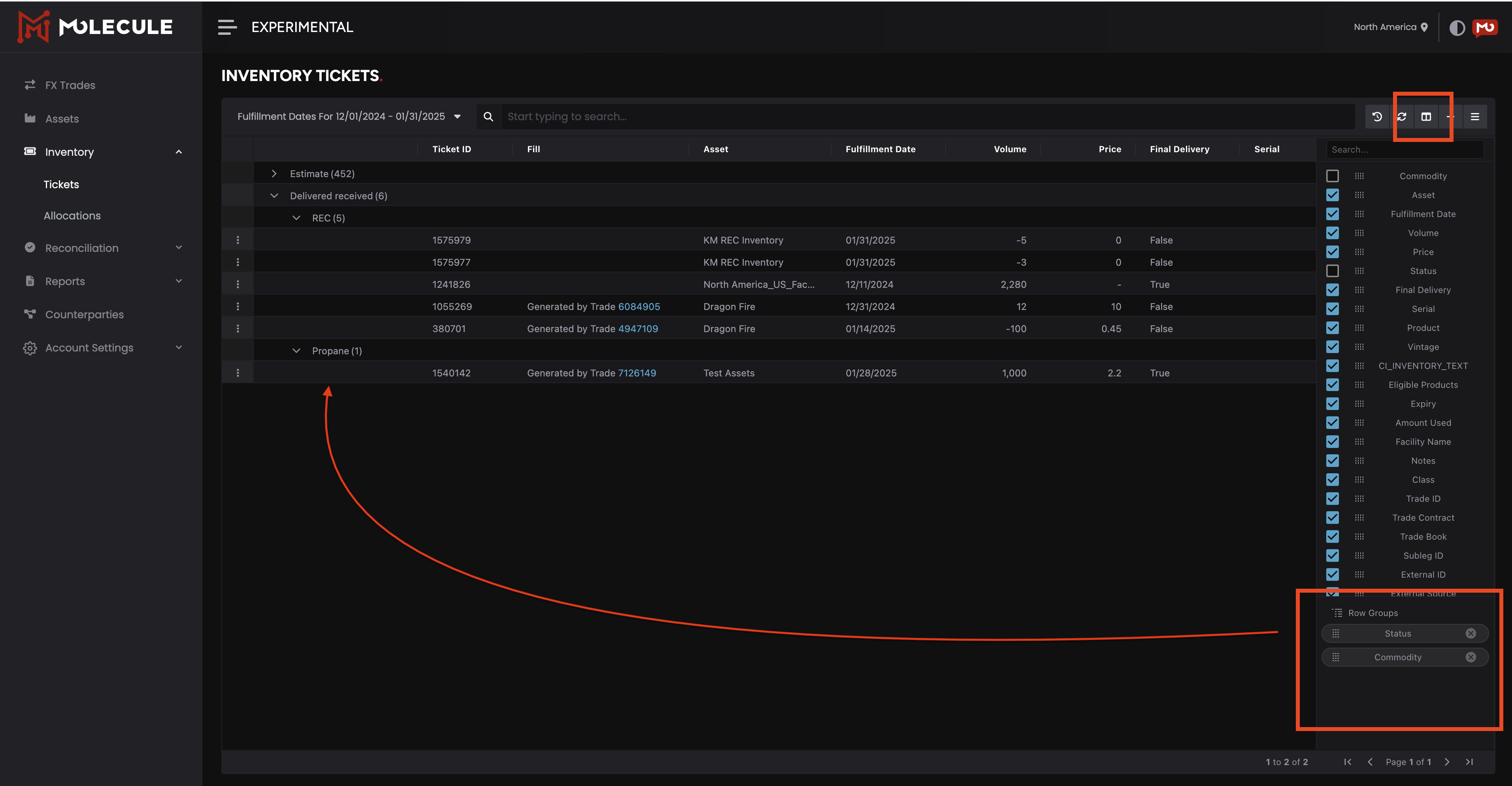

Group By Feature [ALP-117]

Group by on grids is a highly requested feature that has now been implemented across all Mirage screens. Together with the column picker, users can now organize data into logical grouping, tailored to their needs.

Reports Screen Updates [ALP-47]

Visual thumbnail previews allow quick report identification. Optimized loading with intelligent caching improves performance, and a new batch reports grid appears only when relevant.

Access Control Screen: Dynamic Data Refresh [ALP-11]

Components will now automatically update when related data changes. The screen now updates permissions in real time, eliminating the need for manual refreshes.

Streamlined Asset Navigation [ALP-65]

Assets now automatically redirect from legacy screens to the new Mirage interface. Deprecated asset models are clearly marked in admin screens, with improved performance from optimized data relationships.

Spanish Language Support for Tickets Screen [ALP-27]

The Tickets screen now supports full Spanish translation with consistent terminology across the platform.

Coming Soon: Portuguese Language Support in Molecule

We’re adding support for Portuguese in the Molecule app. As Molecule continues to expand globally, you can bet that more languages are on the way. See a preview below.

• • •

🛠️ PLATFORM: API IMPROVEMENTS & BUG FIXES

This release includes some additional enhancements and bug fixes.

Subleg Settlement API Improvements [OME-166]

The API has been extended to support vessel, incoterm, delivery date, and inventory fields, enabling programmatic updates to physical trade settlement details and support for automated deal capture from external systems.

Enhanced APIs [ALP-63]

New performance-optimized APIs for marks and volatilities support bulk operations for faster data management and improved latency for large datasets.

Bug Fixes

Fixed EUA December settlement calculation edge cases (OME-72).

Resolved PPA hourly price inheritance issues for morning intervals (OME-110).

Corrected volume calculations for 15-minute PPA intervals (OME-170).

Fixed contract date display issues in Curve Builder (OME-117).

Eliminated flickering/input loss on the Actualization screen (OME-109).

Enhanced Marex reconciliation for balance-of-month trades (OME-122).

• • •

For support or questions about new features, please contact the Molecule support team.